From “What You Apply” to “What You Eat and How You Choose”

This article analyzes recent research and industry reports from early 2026 to explain how skin aging is increasingly shaped by diet, lifestyle, and consumer decision-making rather than skincare products alone.

🧭 Introduction: Why Skin Aging Is No Longer a Vanity-Table Problem

For decades, skin care was treated as a routine that began and ended at the bathroom mirror.

However, research and reporting published in early 2026 clearly challenge this assumption.

Recent findings on sodium intake and skin aging, dietary vitamin C absorption, and shifts in K-beauty retail driven by foreign consumers all point to the same conclusion:

Skin reflects how we live before it reflects what we apply.

In other words, the pace of skin aging is now better explained by daily habits, nutritional patterns, and product selection behavior than by the number or price of cosmetics used.

🧂 1. The Most Overlooked Accelerator of Skin Aging: Excess Salt Intake

Skin aging progresses gradually, which makes its causes easy to underestimate.

Yet dermatologists and nutrition researchers consistently identify high sodium intake as one of the fastest ways visible skin damage appears.

The World Health Organization recommends consuming less than 2,000 mg of sodium per day.

In reality, average intake in both Korea and the United States exceeds this threshold by a wide margin.

💧 How Excess Sodium Impacts the Skin

When sodium intake remains high, several changes occur simultaneously:

- Moisture balance is disrupted, leading to chronic dryness

- Collagen synthesis is impaired, reducing elasticity and accelerating fine lines

- Fluid distribution in blood vessels shifts, making skin appear swollen, dull, or uneven

These effects are not cosmetic inconveniences—they directly influence structural skin aging.

⚠️ Sodium and Skin Conditions

Research also links sodium intake to inflammatory skin conditions.

Data shows that each additional gram of sodium consumed per day increases the likelihood of eczema aggravation by approximately 22 percent.

As aging naturally weakens the skin barrier, excessive salt intake compounds this vulnerability.

This makes sodium control a foundational component of anti-aging—not an optional lifestyle tweak.

🍊 2. Why Eating Vitamin C Outperforms Applying It

Vitamin C serums remain a winter skincare staple.

However, recent research highlights a key limitation of topical application.

The skin functions as a defensive barrier, making it structurally difficult for water-soluble vitamin C to penetrate deeply when applied externally.

🧬 How Dietary Vitamin C Reaches Skin Cells

Vitamin C consumed through food follows a different biological route.

Human cells contain a specialized transporter known as SVCT (Sodium-dependent Vitamin C Transporter).

This mechanism actively draws vitamin C from the bloodstream into cells—including skin cells.

As a result, dietary vitamin C can reach the dermis more efficiently than topical forms.

📊 Evidence From an 8-Week Clinical Study

A controlled study conducted at the University of Otago in New Zealand provides measurable evidence.

After eight weeks of daily consumption of vitamin-C-rich fruits:

- Skin density increased by approximately 48 percent

- Epidermal regeneration speed increased by roughly 30 percent

These outcomes reflect structural recovery, not short-term surface effects.

⏳ Long-Term Investment, Not a Quick Fix

Vitamin C is not stored in the body and is continuously excreted.

This means benefits depend on consistent daily intake, not occasional supplementation.

Researchers emphasize that dietary vitamin C works as a long-term anti-aging investment, strengthening the skin’s foundation rather than offering immediate cosmetic correction.

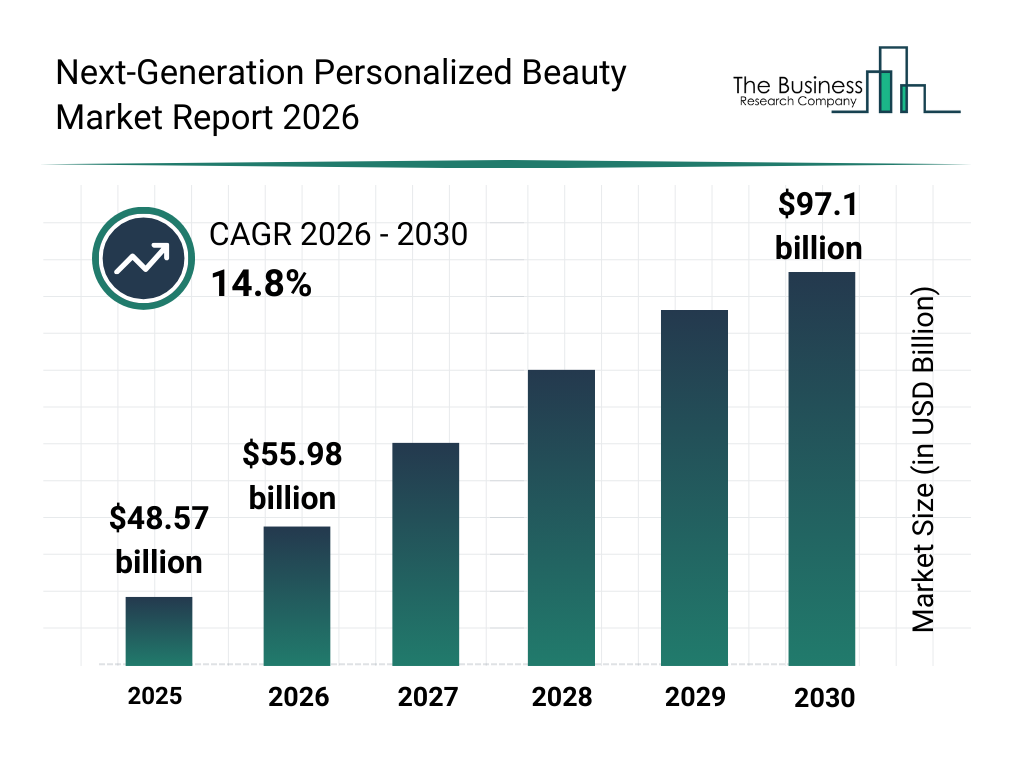

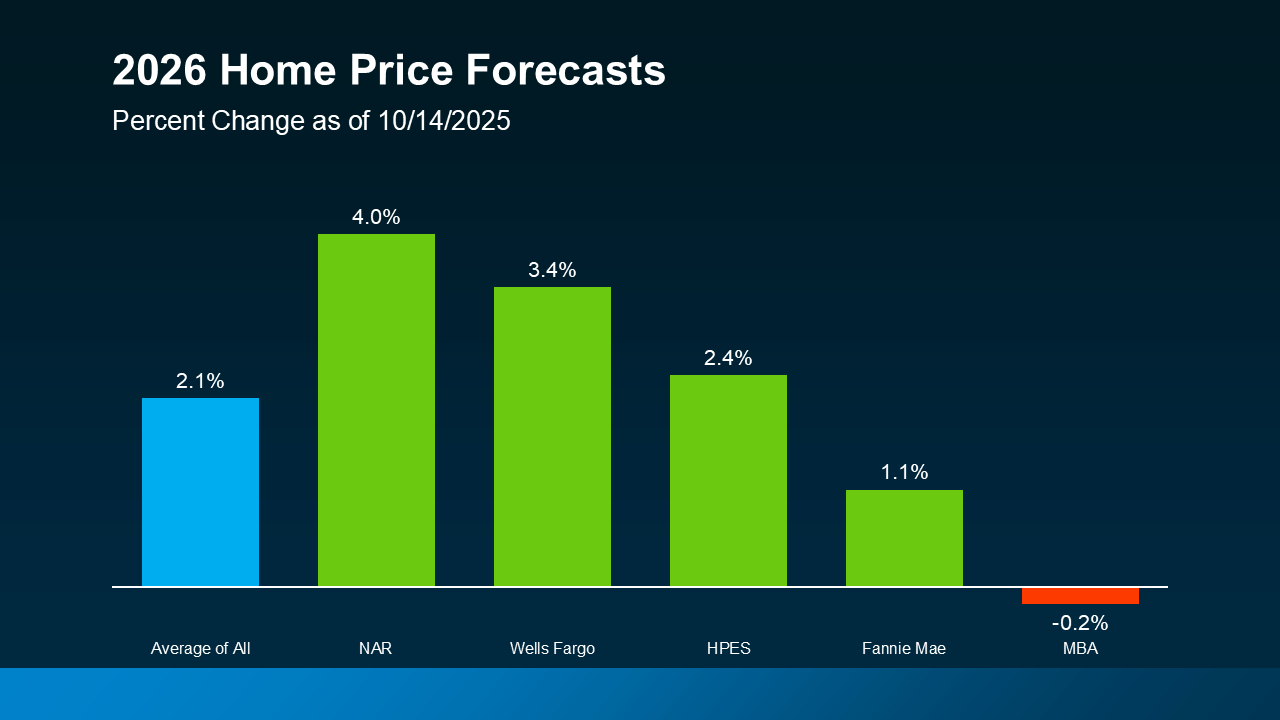

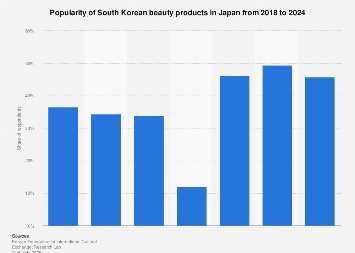

🏬 3. How Skin Awareness Is Reshaping K-Beauty Retail

Changing perceptions of skin health are also reshaping how beauty products are sold.

Reports released in early January 2026 show that foreign visitors are increasingly purchasing from K-beauty specialty stores outside traditional chains.

These stores emphasize selection over scale.

🧠 Defining Features of the New K-Beauty Retail Model

Emerging K-beauty stores share common traits:

- Limited brand counts with concern-based curation

- Focus on dermatological, outlet, or functional positioning

- Strategic placement near cultural and tourist districts such as Bukchon, Samcheong-dong, and Gwangjang Market

Rather than maximizing product exposure, these stores reduce choice overload and guide decision-making.

🌍 Rising Demand From Foreign Consumers

From 2018 to 2024, foreign spending on beauty and health products grew at an average annual rate of 19.1 percent, followed by a surge exceeding 40 percent in 2025.

This trend suggests a shift from impulse buying to lifestyle adoption.

Foreign consumers are not just purchasing K-beauty—they are adopting its underlying care philosophy.

🧩 4. Conclusion: Skin Care in 2026 Means Total Management

Viewed together, these studies and industry reports deliver a clear message:

Skin aging cannot be slowed by a single product or ingredient.

Effective long-term care requires:

- Managing sodium intake

- Maintaining consistent nutritional support, such as vitamin C

- Selecting products through reliable, purpose-driven retail environments

Only when these factors align does skin show stable, sustainable improvement.

🌼 Key Takeaway

Skin is an honest indicator.

It responds less to what is applied today

and far more to the habits repeated every day.

This article is for informational purposes only and does not constitute medical or professional advice.