K-Beauty Global Outlook 2026 shows how the U.S. and Japan are reshaping global demand for Korean beauty through rapid adoption and strong consumer trends.

K-Beauty Global Outlook 2026: The Second Global Expansion

Why the U.S. and Japan Are Leading the 2026 Boom

Key Product Categories Driving Global Demand

Consumer Behavior Shifts in the Post-Trend Era

What This Global Outlook Means for the Future of K-Beauty

Key Product Categories Driving Global Demand

For a closer look at how global consumers choose products, see our guide on 2025 Best Korean Toners for Glowing Skin.

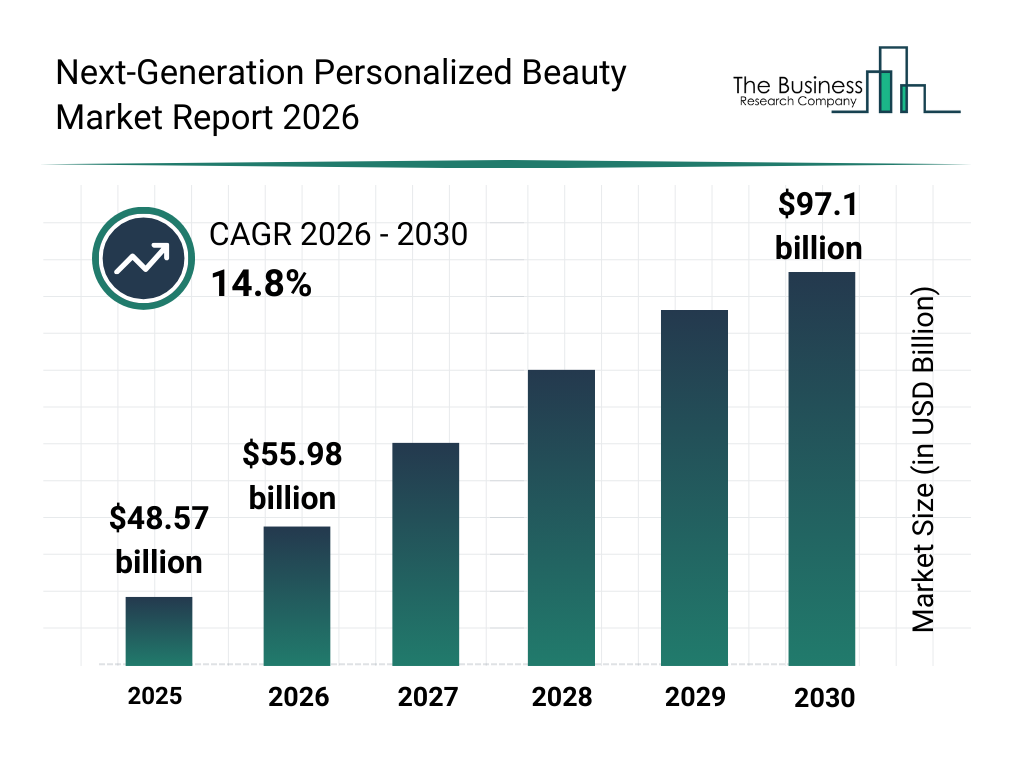

K-Beauty is entering a new growth phase as it expands beyond its former China-centric export structure.

By 2026, the United States and Japan have become the two most influential markets driving what many analysts call “the second global boom of K-Beauty.”

This article summarizes publicly available market insights, social media trends, and category-level shifts shaping K-Beauty’s global trajectory.

This shift marks a defining moment in the K-Beauty Global Outlook 2026.

From an industry perspective, the K-Beauty Global Outlook 2026 highlights how structural demand—not short-term trends—is shaping long-term global growth.

⭐ 1. Key Shifts Defining the 2026 K-Beauty Global Landscape

🧴 1) The U.S. market is accelerating K-Beauty visibility

- Rapid growth on Amazon, Ulta, Target

- Review-driven platforms like TikTok boost discovery

- Ingredient-focused brands (COSRX, Beauty of Joseon, TIRTIR) fit U.S. consumer preferences

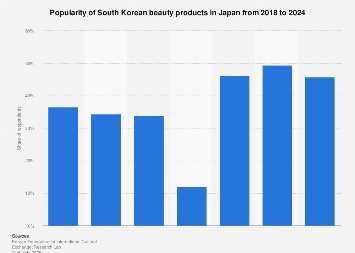

💗 2) Japan sees the fastest expansion in K-Beauty adoption

- Strong acceptance in drugstores

- Japanese consumers prefer gentle, functional formulas

- Long-lasting success of TIRTIR, d’Alba, rom&nd

🍃 3) Global demand diversifies beyond China

- China remains important but no longer the sole growth engine

- U.S., Japan, Southeast Asia now form a three-pillar demand structure

⭐ 2. Why 2026 Represents K-Beauty’s “Second Boom”

✔ Regulatory alignment with U.S. market expectations (MoCRA)

The U.S. now prioritizes ingredient transparency and safety documentation—areas where K-Beauty already excels.

✔ Rise of “review-first consumption culture”

Consumers trust real user experiences more than traditional advertising.

K-Beauty’s lightweight textures and visible application styles perform well in this environment.

✔ Japanese consumer preference shifts

Interest in “hydrating, mild, high-function formulas” aligns perfectly with Korean formulation trends.

✔ Diversified brand ecosystem

Growth no longer comes from only major conglomerates;

small and mid-sized digital brands are leading innovation.

⭐ 3. Why K-Beauty Performs Exceptionally Well in the United States

1) Natural, skin-first aesthetic

U.S. Gen Z prefers skincare-driven routines and subtle makeup—core strengths of K-Beauty.

2) Amazon’s review culture

- COSRX and similar brands gather hundreds of thousands of verified reviews

- Competitive pricing + consistent performance = trust accumulation

3) Fast formulation innovation

K-Beauty updates formulas faster than many U.S. brands (months vs. yearly cycles),

allowing quicker adoption of new textures and mild active ingredients.

⭐ 4. Why Japan Is Experiencing Its Strongest K-Beauty Wave Ever

✔ Perfect fit with Japanese consumer needs

- High portion of sensitive-skin users

- Preference for moisturizing, brightening, low-irritation formulas

✔ Expansion in drugstores

K-Beauty shelves continue to grow across major Japanese chains.

✔ Strong brand positioning

- TIRTIR: long-wear foundation, high coverage

- d’Alba: brightening + premium minimalism

- rom&nd: perfect color adaptation for Japanese skin tones

⭐ 5. The Competitive Structure of K-Beauty in 2026

🧴 Local brands benchmark K-Beauty

U.S. and Japanese brands are adapting Korean-style ingredient strategies.

🧴 Rise of beauty-device + skincare hybrid ecosystems

Brands like APR and LG Pra.L are creating full home-care routines combining devices + cosmetics.

🧴 Strengthening of ODM and ingredient suppliers

Korean raw material and formulation companies (e.g., Cosmax, Kolmar, SBT) increasingly partner with global brands.

⭐ 6. Conclusion: K-Beauty Is Entering a New Structural Uptrend

2026 is not simply another year of recovery—

it represents a strategic shift in how K-Beauty grows globally.

Key signals:

- The U.S. and Japan now serve as stable, high-potential anchor markets

- Social platforms amplify K-Beauty’s strengths in gentle, functional textures

- Korean brands innovate faster than many global competitors

- ODM and ingredient science advance at a global level

K-Beauty is evolving from a trend-driven category to a global reference standard for texture, formulation, and affordability.

⭐ Disclaimer

This article summarizes general, publicly available information for educational purposes only.

It does not make performance, medical, or functional claims about specific beauty products.

To understand how these trends translate into daily routines, explore our K-Beauty Skincare Routine 2025.

This article is for informational purposes only and does not constitute medical or professional advice.

Leave a Reply