From Snail Mucin to RNA: How the Competitive Standard Is Being Redefined Beyond APR

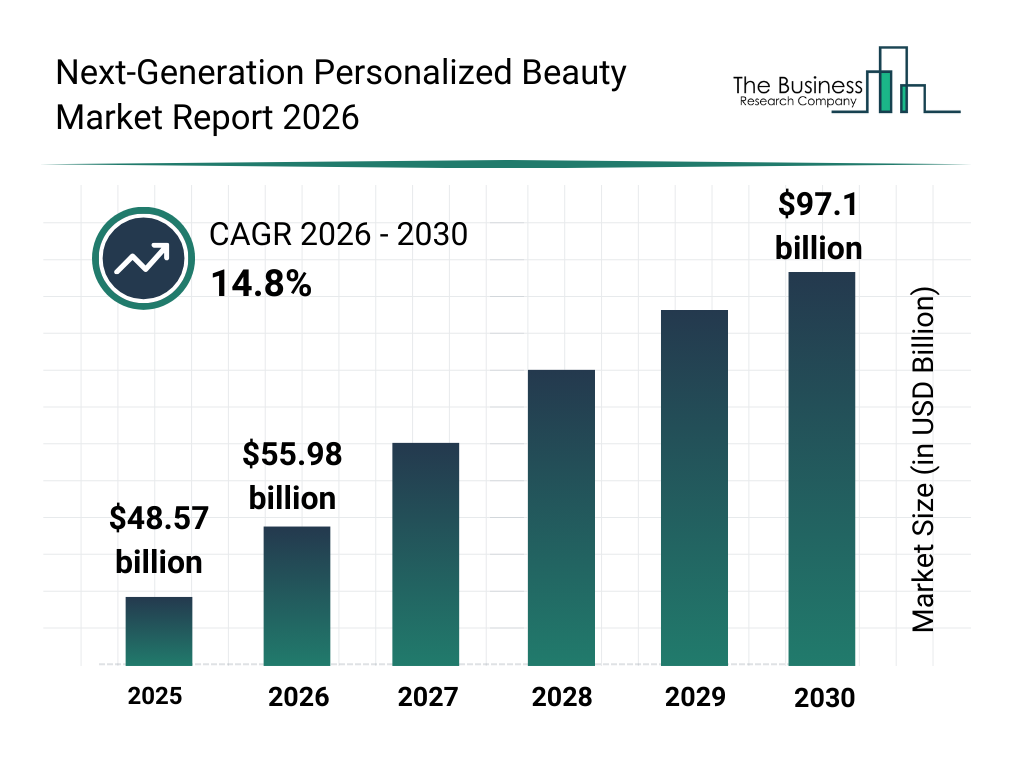

This article analyzes how K-beauty is evolving from an ingredient-driven cosmetics industry into a design- and biotechnology-driven platform industry, based on recent global media coverage, CES 2026 trends, and market data.

🌿 1. Snail Mucin Was Not the End — It Was the Proof of Concept

One of the most iconic milestones that embedded K-beauty into global consumer awareness was the rise of snail mucin serum.

The significance of snail mucin did not lie in its novelty alone.

Rather, it marked the first moment when Korean cosmetics began competing globally on functional narratives—repair, regeneration, and efficacy—rather than branding aesthetics.

According to BBC coverage, the global expansion driven by snail mucin was not a fleeting trend but evolved into a measurable economic engine.

By 2024, Korea’s cosmetics market reached USD 13 billion, and by the first half of 2025, Korea surpassed France to become the world’s second-largest cosmetics exporter, following the United States.

Yet the critical insight is this:

👉 Snail mucin was never meant to be the final answer.

It was the language of first-generation K-beauty, defined by:

- Novel ingredients

- Strong storytelling

- Rapid virality through platforms like TikTok

This success inevitably led the industry to a structural question:

What happens when novelty is no longer enough?

🔬 2. From Ingredient Competition to Design Competition

By 2026, the defining shift in K-beauty is no longer subtle.

The industry is moving away from asking:

“What ingredient did you use?”

and toward asking:

“What biological process are you regulating, and how?”

At CES 2026, K-beauty companies shared several common signals:

- AI-based skin and scalp diagnostics

- Integration of devices and cosmetics

- Personalization, longevity, and data-driven routines

- Emphasis on clinical evidence, reproducibility, and validation

This is not about adding technology to cosmetics.

It represents a deeper structural change:

Cosmetics are becoming outcomes.

Design, data, and biological control are becoming the product.

The fragrance industry underwent this transition earlier.

Where perfumery once depended on intuition and sensory talent, today’s leading fragrance houses operate at the level of molecular structures, diffusion kinetics, and receptor interactions.

Skincare and aesthetics are now following the same trajectory.

🧬 3. Why RNA Signals the Post-PDRN Era

PDRN helped popularize the concept of regeneration in K-beauty.

RNA interference (siRNA), however, introduces a fundamentally different logic.

- Supporting regeneration → Regulating gene expression

- Repairing damage → Preventing damage at the causal layer

This distinction redefines the market itself.

Cosmetics are not pharmaceuticals.

But when cosmetic technologies approach gene expression pathways, they occupy a new strategic position.

Most importantly:

👉 Cosmetics and cosmeceuticals face significantly lower regulatory and clinical barriers than drugs.

By positioning RNA-based technology as:

- a cosmetic

- a functional cosmetic

- or a medical-device-adjacent solution

companies dramatically reduce development time, cost, and regulatory friction.

This is why global players are increasingly translating biotech into cosmetic language.

🌍 4. Why L’Oréal Treats RNA as a Long-Term Strategic Option

L’Oréal’s sustained focus on hair loss, biotech, and RNA is often misinterpreted as short-term diversification.

For a company approaching a USD 300 billion market capitalization, the true objective is different.

Not:

- next quarter’s revenue ❌

But:

- the competitive standard of the next 10–20 years ⭕

L’Oréal understands that:

- Ingredient trends are easily copied

- Marketing advantages decay quickly

- Oils, textures, and formulations create low entry barriers

RNA occupies the strategic gray zone between cosmetics and biotechnology—where:

- technical gaps widen

- data accumulation compounds

- late entrants struggle to catch up

RNA, for L’Oréal, is not a product bet.

It is an option on the future structure of the industry.

🚀 5. Why APR Is No Longer Competing Inside K-Beauty

Recent discussions around APR often focus on short-term stock movements.

From an industry perspective, this misses the point.

APR has already exited intra–K-beauty competition.

Evidence includes:

- Sustained Top 3 skincare ranking at ULTA (U.S.)

- Direct competition with global brands

- Integration of devices, cosmetics, and data

- High operating margins with strong overseas exposure

APR’s true peer group is no longer domestic cosmetics brands.

It now competes with global skincare platform companies.

The structural implication is clear:

👉 APR is not the end state—it is the present.

Which raises the next strategic question:

What defines the post-APR competitive standard?

Repeatedly, the answer points toward RNA, biotech, and design-driven platforms.

🌱 Conclusion: K-Beauty Has Already Moved Beyond Cosmetics

Snail mucin symbolized K-beauty’s global breakthrough.

APR demonstrates its arrival into the global mainstream.

RNA represents something else entirely:

👉 a test of how far K-beauty can move beyond the cosmetics industry itself.

This transition is gradual—but irreversible.

The market no longer asks:

“What was applied?”

It asks:

“Why does it work?”

🌼 Key Takeaway

K-beauty is no longer defined by ingredients or trends.

It is entering an era shaped by design, data, and biotechnology.

Snail mucin was the beginning.

APR is the present.

RNA defines the next question.

This article is for informational purposes only and does not constitute medical or professional advice.